Investors Question If Stock Market Rally Can Last: Nothing Is Obvious

Investors are debating whether the dynamic rebound in Americas stock markets is part of a sharp, V-s..

Investors are debating whether the dynamic rebound in Americas stock markets is part of a sharp, V-shaped recovery or a short-lived “dead-cat bounce” that will soon fade and see risk assets plunge to new lows.

The pandemic-driven lockdowns have sparked an economic catastrophe that, since states began implementing stay-at-home orders in March, has seen more than 36 million people file jobless claims and led to expectations of GDP contraction in the second quarter of over 30 percent, on an annualized basis.

Wall Street, however, appears dismissive of the harsh economic realities of Main Street, with major indexes like the Dow Jones Industrial Average and the S&P 500 up nearly 30 percent off their March lows. Stocks surged on Wednesday, with the Nasdaq hitting a three-month high.

Traders work on the floor of the New York Stock Exchange (NYSE) in New York City on Sept. 18, 2019. (Spencer Platt/Getty Images)

Traders work on the floor of the New York Stock Exchange (NYSE) in New York City on Sept. 18, 2019. (Spencer Platt/Getty Images)Some argue stocks are being buoyed by a combination of unprecedented central bank stimulus, expectations that virus-related lockdowns will be short-lived, and growing clarity about the nature of the disruption.

“This economic downturn is severe, yet scripted. For the first time, investors have anticipated awful economic data, months prior to its release,” said Allen Sukholitsky, chief macro strategist at Xallarap Advisory, in remarks to The Epoch Times.

He said much of the bad economic news has been priced in and markets measure uncertainty relative to known factors, not “uncertainty in a vacuum.”

“Before the global financial crisis, falling housing prices were widely considered an impossibility. Yet, for over two months now, scientists have been modeling the spread of COVID-19 and economists have been modeling the impact of non-consuming consumers,” he said, adding, “This rally has room to run.”

Most fund managers polled by Bank of America between May 7-14 disagree, however, with 68 percent saying they believe the furious upwards tear in stocks is a short-lived bear-market rally that will fade and fall.

Only 10 percent of the 223 surveyed investors predicted a V-shaped rebound, while 75 percent said they expect a grinding recovery that could be in the shape of a “U” or a “W.”

“I fear that the recovery is more likely to be W shaped—that is, a recovery, subsequent drop, and another slower recovery,” said Robert Johnson, professor of finance at Heider College of Business, Creighton University, in remarks to The Epoch Times.

Johnson said a major risk to an optimistic scenario is a secondary outbreak of the virus that forces another round of social distancing, stalling the recovery.

“The recent stock market recovery seems premature and is largely based upon hope that the unprecedented infusion of cash by the U.S. government will soften the economic consequences of shutting down a substantial portion of the economy,” he said.

U.S. stocks have staged a furious rally off March lows on unprecedented stimulus by the Federal Reserve, but gains have been limited this month as traders digest mixed headlines on progress in developing a vaccine.

On Wednesday, the S&P 500 was about 12 percent below its all-time peak and the Dow Jones index was short by 17 percent.

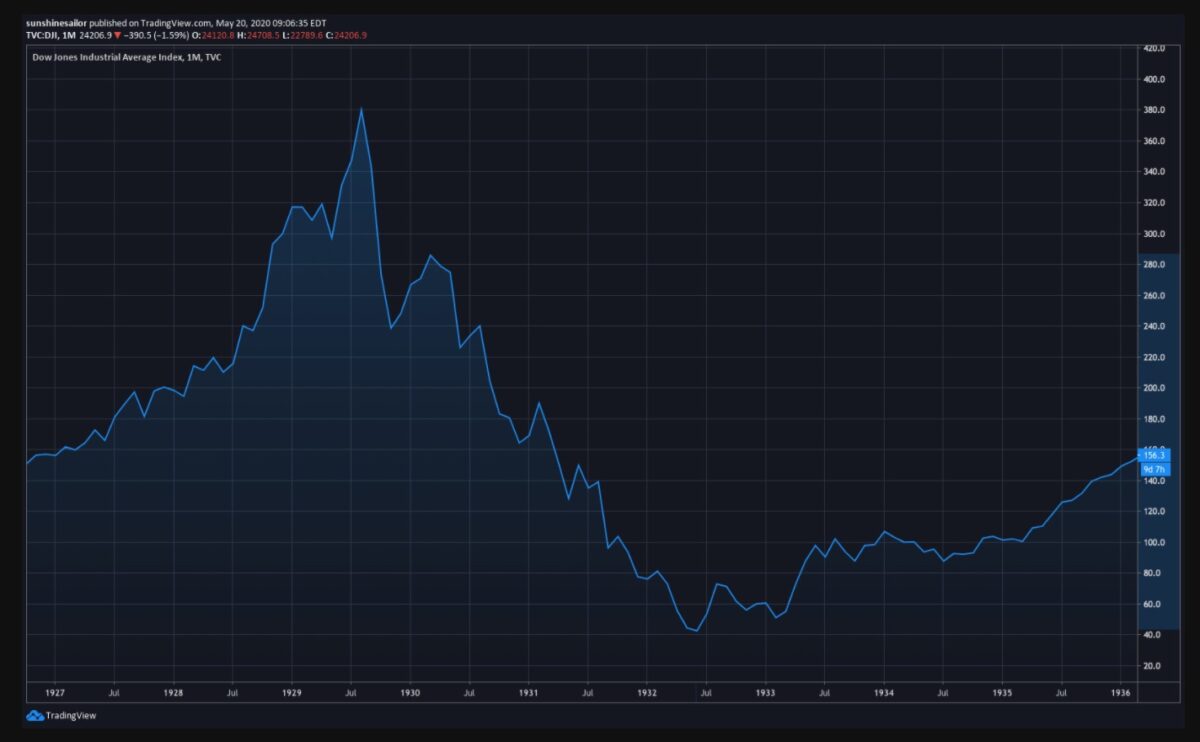

But the shape of previous bear market prints in major Wall Street indexes, like the Down Jones Industrial Average, suggests expectations for more downside are not unreasonable.

The 1929 market meltdown, for instance, saw the Dow Jones fall by around 37 percent, rally by some 20 percent, before grinding down by another 83 percent or so over the course of several years to hit its final trough.

The 2008 financial crisis saw a similar dynamic of a short-lived rally followed by a plunge to new lows, although a longer time horizon revealed a silver lining.

“The middle of October 2008 was a dark time. And yet if you had a crystal ball you would have seen 25% downside and 120% upside over the coming five years, as turned out to be the case,” said Nick Reece, senior analyst and portfolio manager at Merk Investments, in remarks to The Epoch Times.

“That probably would have sounded overly optimistic at the time. But nobody has a crystal ball,” he added.

Max Gokhman, head of asset allocation at Pacific Life Fund Advisors, said four factors explain the disconnect between Wall Street and Main Street.

The first is that, even as many economic data prints were dismal, investors expected “atrocious results and knew the error bands arouRead More – Source