US GDP Suffers Record Collapse, Jobless Claims Point to Stalling Recovery

The U.S. economy suffered a historic collapse in the second quarter of this year, with Commerce Depa..

The U.S. economy suffered a historic collapse in the second quarter of this year, with Commerce Department figures showing gross domestic product (GDP) plummeting by 32.9 percent in annualized terms as business activity ground to a halt due to the pandemic.

The unprecedented economic contraction, which is an advance estimate released by the Commerce Departments Bureau of Economic Analysis on July 30, is more than triple the previous all-time GDP drop of 10 percent in the second quarter of 1958.

“Markets were pretty much expecting a disastrous number, and they got it. The recovery is going to take time,” said Mizuho Securities USA chief economist Steven Ricchiuto.

Most of the drop in GDP took place in April, when business activity ground to a halt as the country was under lockdown to curb the spread of COVID-19.

Many businesses resumed operations in May, fueling hopes for a quick rebound. But a resurgence of COVID-19 cases, especially in the densely populated South and West, are tempering hopes for quick economic recovery.

“The bottom fell out of the economy in the second quarter,” said Sung Won Sohn, a finance and economics professor at Loyola Marymount University in Los Angeles. “The outlook is not very good. Americans are not behaving well in terms of social distancing, the infection rate is unacceptably high, and that means economic growth cannot gain any traction.”

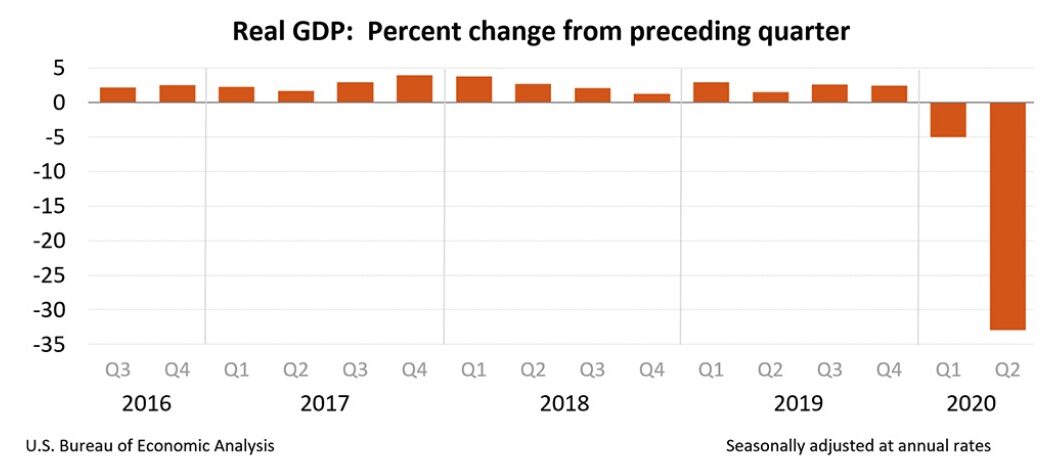

U.S. gross domestic product (GDP), percent change from the preceding quarter, seasonally-adjusted, annualized. (Commerce Department)

U.S. gross domestic product (GDP), percent change from the preceding quarter, seasonally-adjusted, annualized. (Commerce Department)The Commerce Department said the second-quarter economic crash was driven by lockdowns sparked by the outbreak of COVID-19, adding that the dismal number likely doesnt reflect the full impact of the pandemic response.

“The decline in second-quarter GDP reflected the response to COVID-19, as stay-at-home orders issued in March and April were partially lifted in some areas of the country in May and June, and government pandemic assistance payments were distributed to households and businesses,” the department stated.

“This led to rapid shifts in activity, as businesses and schools continued remote work and consumers and businesses canceled, restricted, or redirected their spending.”

The drop in GDP reflected decreases in personal consumption expenditures, exports, private inventory investment, and nonresidential and residential fixed investment, along with state and local government spending.

Adding to the economic gloom was a disappointing jobless claims report, also released July 30, which showed that initial weekly unemployment filings rose for the second straight week after steadily falling from its March peak of almost 7 million. For the week ending July 25, the number of Americans filing jobless claims was 1,434,000, an increase of 12,000 from the previous week, Labor Department figures show (pdf). By comparison, the pre-pandemic peak in new weekly jobless claims in America was 695,000, dating back to 1982.

A relative bright spot in the jobless numbers is the figure for continuing claims, which reflect people who earlier filed an initial claim and now continue to receive unemployment benefits. While the number of workers continuing to collect unemployment spiked by 867,000 during the week ending July 18, about a million workers went off unemployment the week before, so the net number of workers on continuing claims is lower over a two-week period.

“So, the net was still lower over the whole two week period in continuing claims than we thought, which implies to me that what were seeing in July data is more of an inflection point than a topping out in the economy, basically,” Ricchiuto said. “So, were not reaching an extreme, but weve basically inflected into a slower growth rate.”

Also, the total number of people collecting benefits in all unemployment programs for the week ending July 11 dropped by 1.6 million compared to the previous week.

“We all know that shutting down the economy was going to lead to a very, very sharp contraction in GDP. But theres also evidence of a sharp rebound as well,” Ricchiuto noted.

Still, the July 30 economic data broadly reinforces the theme that the momentum of economic recovery has slowed, especially in places that have seen a surge in COVID-19 infections.

The Federal Reserve on July 29 acknowledged that the spike in cases was likely stalling recovery, while pledging to support the economy as long as necessary, guaranteeing it will continue to flood the financial system with cheap funds and fueling a rally in Wall Streets three main indexes late in the July 29 session.

Wall Street on July 30 had been trading largely flat, while the yield on the benchmark 10-year Treasury note dove to around 0.54 percent in the morning, marking the first time the benchmark rate has traded below the 0.55 threshold in more than three months. Falling Treasury note rates reflect a risk-off sentiment as investors seek safety amid uncertainty. The Wall Street fear gauge, or the VIX voRead More – Source