Jobless Claims Stay Flat at 884,000 in a Sign of Labor Market Struggles

The number of Americans filing new claims for unemployment benefits last week stayed unchanged from ..

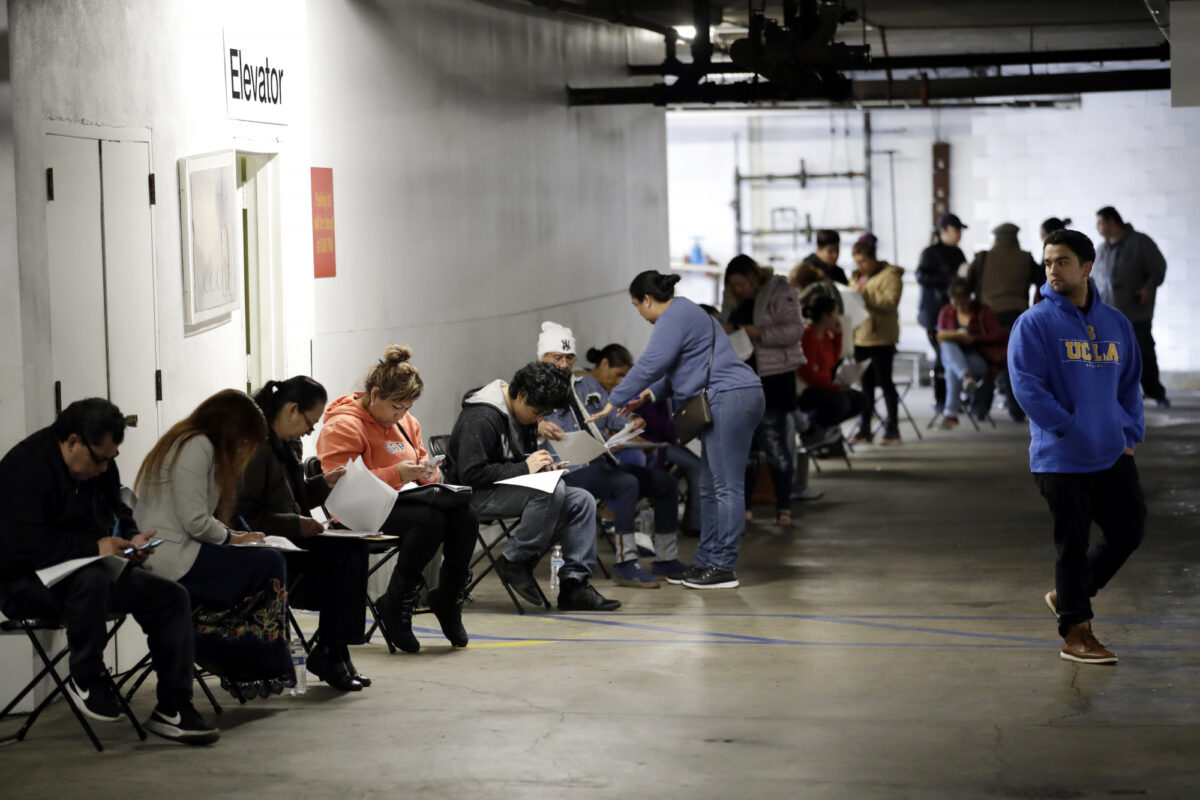

The number of Americans filing new claims for unemployment benefits last week stayed unchanged from the week before at just over 880,000, suggesting the labor market recovery has lost some steam.

The Labor Department said in a release on Thursday (pdf) that initial claims for state unemployment benefits came in at a seasonally adjusted 884,000 for the week ended Sept. 5, the same level as the previous week, which in the current release was revised upward from 881,000.

“Thats more than four times the average early this year of 218,000 in the 11 weeks before the pandemic mushroomed,” said Bankrate.com senior economic analyst Mark Hamrick, commenting on the figures.

The insured unemployment rate was 9.2 percent for the week ending Aug. 29, an increase of 0.1 percentage point from the previous weeks rate, while the number of Americans continuing to collect unemployment benefits in state programs, after earlier filing an initial claim, rose by 93,000 to 13.385 million during the week ending Aug. 29.

The total number of people claiming benefits in all programs for the week ending Aug. 22 was 29.6 million, an increase of over 380,000 from the week prior. By comparison, in the comparable week in 2019, there were 1.6 million people claiming unemployment benefits in all programs.

Broken down by states, the biggest increases in initial unemployment claims for the week ending Aug. 29 were in California (+22,647), Texas (+4,521), and Louisiana (+3,662), while the states with the highest insured unemployment rates in the week ending Aug. 22 were Hawaii (20.3), Puerto Rico (16.7), and Nevada (16.0).

U.S. stock index futures eased on Thursday, following the S&P 500s biggest one-day jump in three months, as investors awaited the weekly jobless claims data to get a sense of the dynamics of the recovery. According to some measures, like new housing starts, retail sales, and equities, the recovery has been sharp. Other measures, like non-farm payroll data and jobless claims, as well as reports from specific industries like travel and entertainment that have been hit especially hard by the CCP (Chinese Communist Party) virus, show that recovery has slowed.

“With the summer months behind, the seasonal aspects of COVID-19 including the need to spend more time inside pose risks to the economy,” Hamrick said in an emailed statement. “Back-to-school, Halloween, and holiday shopping will all have a constrained mode this year. As brick-and-mortar retailers, bars, and restaurants continue to operate below par, the risk of permanent job loss remains ever present,” Hamrick added.

After pandemic-driven lockdowns drove non-farm payroll employment to fall by 701,000 Read More – Source